Why choose IRIS Cascade?

Discover a harder-working HR solution

HR software shouldn’t just make life easier for your HR department – it should empower you to make the most of your people and improve how you run your business.

IRIS Cascade is a powerful HR system that takes care of core HR functionality and more. Cut down on admin, streamline HR processes, and boost efficiency by managing all aspects of your HR operations within a single platform.

-

HRintuition

Your HR team uses one centralised database, one source of truth. Unparalleled reporting means better HR strategies, real-time data, and error-proof HR and payroll.

-

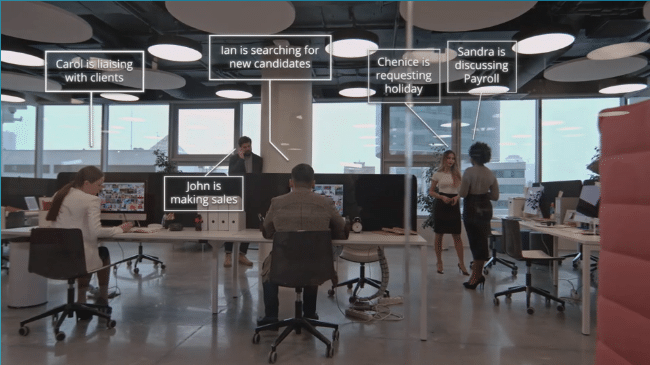

HRinteraction

Staff can easily request holidays, view payslips and submit information. Your HR professionals, meanwhile, build their capabilities around smart, modern software.

-

HRintelligence

Flexible, easy-to-use workflows allow your HR team to customise software, adapt to new situations and excel in core duties

Streamline HR processes

A centralised HR database with admin automation

Rely on an integrated cloud-based HR system that provides you with a universal source of secure, up-to-the-second employee data.

- Never worry about lost or duplicated data again; a secure online system is always up to date

- Streamline internal HR workflows and let automation features process data across the business.

- Generate accurate reports on gender pay gaps, staff turnover, and diversity in seconds.

Self-service features

A complete staff management solution

Empower your people by offering staff a secure self-service employee portal.

IRIS Cascade’s cloud-based online system allows you to log onto an accessible employee platform anytime or anywhere, completing tasks like:

- Checking and requesting annual leave

- Tracking and logging data relating to absence

- Viewing and downloading payslips

IRIS Cascade

Streamline your HR process and empower your people

Discover a fully-integrated software solution that brings all your HR functionality onto one cloud-powered dashboard. From payroll to performance management, IRIS Cascade helps you take better care of your people and your business.

IRIS Cascade Modules

Software that scales with your business

Alongside core HR functions, IRIS Cascade can also be scaled up to meet any extra requirements. Explore Cascade’s additional modules and learn how they can help you manage the entire employee lifecycle.

Helping businesses expand and grow

Acorn Stairlifts

“IRIS Cascade has given us one central place we can store and access all the reporting information. It’s a powerful tool for managers; you can see your team in a snapshot with the reporting dashboard. We’ve been very happy since adopting IRIS Cascade. It’s enabled us to become more efficient and focus on higher value HR activities.”

Frequently Asked Questions (FAQs)

Learn more about our IRIS Cascade solutions, from tech specs to insight into the set-up process.

-

A dedicated project manager and a team of consultants will manage the implementation of your solution from start to finish.

Once you’re all set up and raring to go, you’ll be connected with a named contact who is assigned to support you going forward so you can get the most of your system. Plus, you’ll be connected with our in-house Service Desk, dedicated to answering all your questions post-setup.

To support your transition to IRIS Cascade, we provide a comprehensive Help Centre which covers almost everything you’ll need to know about getting up and running. You can also visit the ‘Getting Started with IRIS Cascade’ section of the Help Centre for more help and information.

In addition to this, there is also a suite of handy, downloadable guides on how to implement IRIS Cascade and its modules. If you still need help with installing or using IRIS Cascade, you can contact our team of experts directly.

-

Alongside access to a wide range of ongoing support (see the FAQ above for more details), you will also receive initial training as part of your implementation plan.

If you want to delve into more detail, we have a full range of training courses on offer to help you get the best from IRIS Cascade.

-

Software upgrades are a standard part of your subscription and will be actioned automatically. You will not need to monitor or manually install updates to your software.

-

Of course you can see what IRIS Cascade can do before purchasing. You can request a demo to see our software and modules in action.

However, the great thing about IRIS Cascade is that you can build your HR system your way, based on yours and your team’s unique requirements.

Alternatively, you can request a demo of a particular module by visiting the respective product pages, which are listed here:

- IRIS Cascade Payroll

- IRIS Cascade Expenses

- IRIS Cascade Recruitment

- IRIS Cascade Training & Development

- IRIS Cascade Timesheets

-

If you’re not sure whether IRIS Cascade is for you, or which modules you might benefit from, you can speak to our friendly sales team.

Get in touch with our sales team by visiting the Contact Us page and selecting “I would like to find out more about IRIS products” and completing the contact form under “HR / Payroll / Recruitment”.

-

If you already have one of the Cascade modules, you can very easily add another. For example, if you’re interested in adding the IRIS Cascade Recruitment module to your Cascade HR software, all you need to do is contact our sales team to discuss your requirements.

The new module will integrate seamlessly with your existing IRIS Cascade setup.

-

IRIS Cascade Payroll is recognised by HMRC as software you can use to report PAYE information online.

In addition, the Expenses+ model of the IRIS Cascade Expenses module also provides HMRC recognised software services.

Want to find out more?

Get in touch with our team

Learn more about IRIS Cascade and how it’s supporting businesses like yours

Case Study

Acorn Stairlifts

We’ve been very happy with adopting IRIS Cascade, because it’s enabled us to become more efficient and focus on higher value HR activities.

Blog Article

Paying attention to employee retention

If businesses want to prevent losing existing employees to competitors and being forced to continuously reinvest in recruitment, retention must become an even bigger priority.

Webinar

All things Cascade

Cascade HRi can assure you of a solution that supports and reflects the changing needs of your HR function and adapt to any level of business complexity. Watch our webinar on-demand now!